PERSONAL INCOME TAX FROM EMPLOYMENT INCOME

I. Who should pay personal income tax from wages?

Resident individuals: Individuals who meet one of the following two conditions:

- Individuals present at VN from 183 days or more in a calendar year or for 12 consecutive months since the first day to VN.

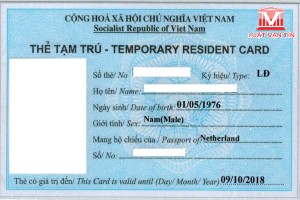

- Individuals who have permanent residence in VN such as: place of registering permanent residence, obtaining the permanent, temporary resident card issued by Ministry of Public Security or rent to stay from 90 days or more in a taxation year.

Non-resident individuals: persons who do not meet the above conditions.

1. Income from taxable wages?

- Wages in all forms

- Allowances, subsidies, other than some allowances, subsidies

- Remuneration (commissions, royalties, joining in ....)

- Other benefits in cash or awarded in non-cash

- Bonuses in month, quarter, year, unexpectedly, 13th month salary in cash or in shares under the bonus value recorded on the books.

2. These allowances shall be deducted when calculating the income tax?

-

Rent allowance: The amount the rent, electricity, water and related services (if any) for housing paid by the employer shall be taxable income calculated in accordance with the actual payment in lieu of but not exceed 15% of taxable income generated (not including rent, utilities and related services (if any)) at the entities regardless of source of the income. "

-

Money to work at night, overtime is paid higher than salaries, wages work per day, work in hours.

-

Cash support for hospitality, entertainment for themselves and employee’s family:

-

Deduction of family allowances:

- Self: 11,000,000 VND/month

- Dependants: 4,400,000 VND/month/person

- Children under 18 years of age based on the birth certificate

II. Calculation of personal income tax?

Personal income tax payable = Taxable income x tax rate

Taxable income = Taxable income (*) - Deductions

|

Grade |

Taxable income/ month |

Tax rate |

Calculation of amount of personal income tax |

|

|

Option 1 |

Option 2 |

|||

|

1 |

Up to 5 million dong (m.d) |

5% |

0 m,d + 5% Taxable income |

5% Taxable income |

|

2 |

Over 5 m.d to 10 m.d |

10% |

0,25 m.d + 10% Taxable income over 5 m.d |

10% Taxable income - 0,25 m.d |

|

3 |

Over 10 m.d to 18 m.d |

15% |

0,75 m.d+ 15% Taxable income over 10 m.d |

15% Taxable income - 0,75 m.d |

|

4 |

Over 18 m.d to 32 m.d |

20% |

1,95 m.d + 20% Taxable income over 18 m.d |

20% Taxable income - 1,65 m.d |

|

5 |

Over 32 m.d to 52 m.d |

25% |

4,75 m.d + 25% Taxable income over 32 m.d |

25% Taxable income - 3,25 m.d |

|

6 |

Over 52 m.d to 80 m.d |

30% |

9,75 m.d + 30% Taxable income over 52 m.d |

30 % Taxable income - 5,85 m.d |

|

7 |

Over 80 m.d |

35% |

18,15 m.d + 35% Taxable income over 80 m.d |

35% Taxable income - 9,85 m.d |

Please contact us, LVT Lawyers, Lawyers in consulting for foreign employees in Vietnam.

LVT Lawyers with a team of lawyers with many years of experience in consulting for foreign employees in Vietnam. Along with the enthusiasm and dedicated work, we assure putting the interests of clients on the top to fit the motto "Our services, your success". LVT Lawyers provide consulting services for foreign employees in Vietnam as follows:

-

Consulting on regulations of law for foreign employees in Vietnam;

-

Consulting on the procedures for recruitment;

-

Consulting on regulations about salaries, bonuses, compulsory insurance in the enterprise

-

Consulting on setting up the wage scale and payroll for businesses; form, procedure in payment compensation, bonus for employees, personal income tax for employees;

-

Consulting on female employees, maternity policy, insurance for female employees;

-

Consulting on entering the labor contracts, termination of labor contracts;

-

Consulting on material liability, labor discipline, hours of work and rest, the problems related to health conditions, working conditions, safety and occupational health;

-

Consulting on conditions, disciplined procedures to employees, assess the legality of decisions of labor discipline;

-

Consulting on procedures in settlement of allowances, insurance to employees upon termination of the labor relations;

-

Consulting on the conditions and procedures for the recruitment and use of foreign labor; Drafting dossier for work permits for foreigners working in Vietnam; implementing procedures to apply for a work permit of foreign employees;

-

Consulting on issues Immigration procedures, registration of temporary residence, wages, personal income tax for foreign employees in Vietnam.

-

Consulting how to deal with labor disputes, procedures for settling labor disputes.